If you’ve ever worked with inherited home sales, you know how emotionally charged the process can be. Not only has the person selling recently lost a loved one, but there are often multiple players involved — some of whom don’t agree on what should be done with the home.

Over the last few weeks, we’ve talked with Authorify members who have worked in the inherited homes niche. We gathered their advice on dealing with highly emotional clients and ensuring the sale goes smoothly from start to finish.

Working with Emotional Clients

“It's just such a unique experience whenever you're working with them because it's one of those bittersweet things you’ve got to walk through,” says Marie Surratt, an agent from Tampa. “You listen to them talk about all the times that they had in that house and everything. So it's kind of like being empathetic and being there to support them and try to celebrate the life that they had and just kind of walk through and listen to them. And if you listen and relate — that's actually how I got one of the listings is because they're like, ‘Oh, you're the only one that is actually letting us talk about everything that's happened.’ And I think that's important for them to be able to get that closure.”

Marie says helping people through an inherited home sale is a form of healing, and she doesn’t take that responsibility lightly.

“I'm looking at it as like maybe taking one of those issues off so that a family can come back together, you know, because when you have the divide and trying to figure out what to do with this house and how to do this, and ‘Oh, well, why did mom say that they get to be in charge? And, you know, you have all those different emotions that — I just find that very rewarding as part of my job.”

Tiffany Hudson, an agent from Pembroke Pines, Florida, says securing inherited listings takes a modified approach.

“You know, as agents, we love to talk, and we have, you know, our script in our heads and everything else. But it's about being quiet and listening to the client's needs and coming from contribution. And if we put that in our mind first and foremost, all the time, then we'll always have happy clients.”

Home Pricing

Marie says one of the most challenging parts of listing an inherited home is attempting to take the emotion out of price setting.

“I would tell them, ‘Yeah, it's priceless,” ... but what you're trying to put a price on are your memories that you've had here. And you have those memories to take with you — like that's the one thing no one can take away. Realistically, if a tornado came through, if we had a hurricane and this house was wiped out, what would you have to spend to put it back? And that's what you're looking at when you want to talk about the value. And I also tell them to look at it — you know, the market value is only what somebody is willing to pay for it.”

David Olson, an agent from Cold Springs, Minnesota, says it’s important to approach pricing objections with solid facts.

“I just show them the data for what the type of the property has and how that's sold. So if they grew up in the house in the 70s or 80s, and they have certain memories there, I still have to show them properties that were built in the 70s and 80s and what they're selling for.

“So the value is the dollar of the house and not their intrinsic value that the family members might have. ...That's just the way it works. And they just have to start understanding that, but it might take a week or two for them to come to that realization.”

Preparing the Home for Sale

One of the hurdles Tiffany frequently has to overcome is getting clients to separate emotions from the home so they can properly prepare it for sale.

“What I normally do is I will say to them, envision a buyer coming into this house — you know, buyers buy on emotion. So we really want to neutralize the space so that they can envision themselves and their family in here. We want to put away personal items, photographs, memorabilia, and I always say to them, it's a good idea to start packing them now. And I’ll walk the house with them. I normally do like a free staging consultation. Sometimes, it's good to have a neutral party come in if you don't feel comfortable with having that conversation yourself. Because it definitely helps to get the seller on board and help them to understand the process of neutralizing and making it less personal because especially with older sellers and people that are dealing with grief, you know, everything is personal to them. And that space that does hold so much memories.”

Marie explains to her clients that any updates and adjustments they are willing to make to the home will impact the amount of money they receive for it.

“If you want this for your house, then you need to do X, Y, and Z. If you just want to paint and do a few things, you can get this for the house. If you want to sell it just as it sits and do nothing, this is what we're going to get. So you have a range to choose from. And then I let them talk about it, to decide. Top houses are immaculate. Like you're going to have to paint, maybe update the flooring, update the countertops and put, you know, five or $10,000 into it to get this price. If you look around and you go, well, you know, the baseboards need painting, the walls, need painting, and just really give it all a good cleaning, scrub the windows and everything. You're going to spend maybe $1,000/$2,000. We can price it right here.

Managing Multiple Players

As we previously mentioned, there are often multiple parties involved in an inherited home sale. It’s important to understand each of their roles and appeal to them.

“I would say, just really be prepared to be a great listener, to be able to hear the emotions and hear what they're actually saying and how they're feeling so you can make the connection and help them start,” Marie says. “For the most part, you might have one or two of them that are just looking at a number sense, like let's get rid of this house and let's just move on.

Especially if you have one family member that was there taking care of someone or that was there all the time and someone that lives out of state.

“So you have to be able to put different hats on whenever you're there.

Especially if you have one family member that was there taking care of someone or that was there all the time and someone that lives out of state.

“So you have to be able to put different hats on whenever you're there.

Listening will help you figure out how to deal with each person. And I mean, and they're not all good. Not all family members get along. So, you know, it's trying to bridge that gap and trying to get them to all come to an agreement because when you can't get them all to come to an agreement, you know, there's no deal. Because it's all or none, not a majority rules.

Ed Hru, an agent who specializes in divorce and probate listings, understands the dynamic of an inherited sale because he went through one himself.

“I know that when my parents died, there was friction between the three sons. One of them didn't like the fact that another one was the personal representative and made choices. He didn't like those choices. So even with our own family, we had disagreements on everything. You have people that don't need the money and you have people that really need the money. So there might be a difference between somebody who really wants to sell and somebody who says, no, let's wait until the market gets a little better.”

Other Ways to find Inherited Homes.

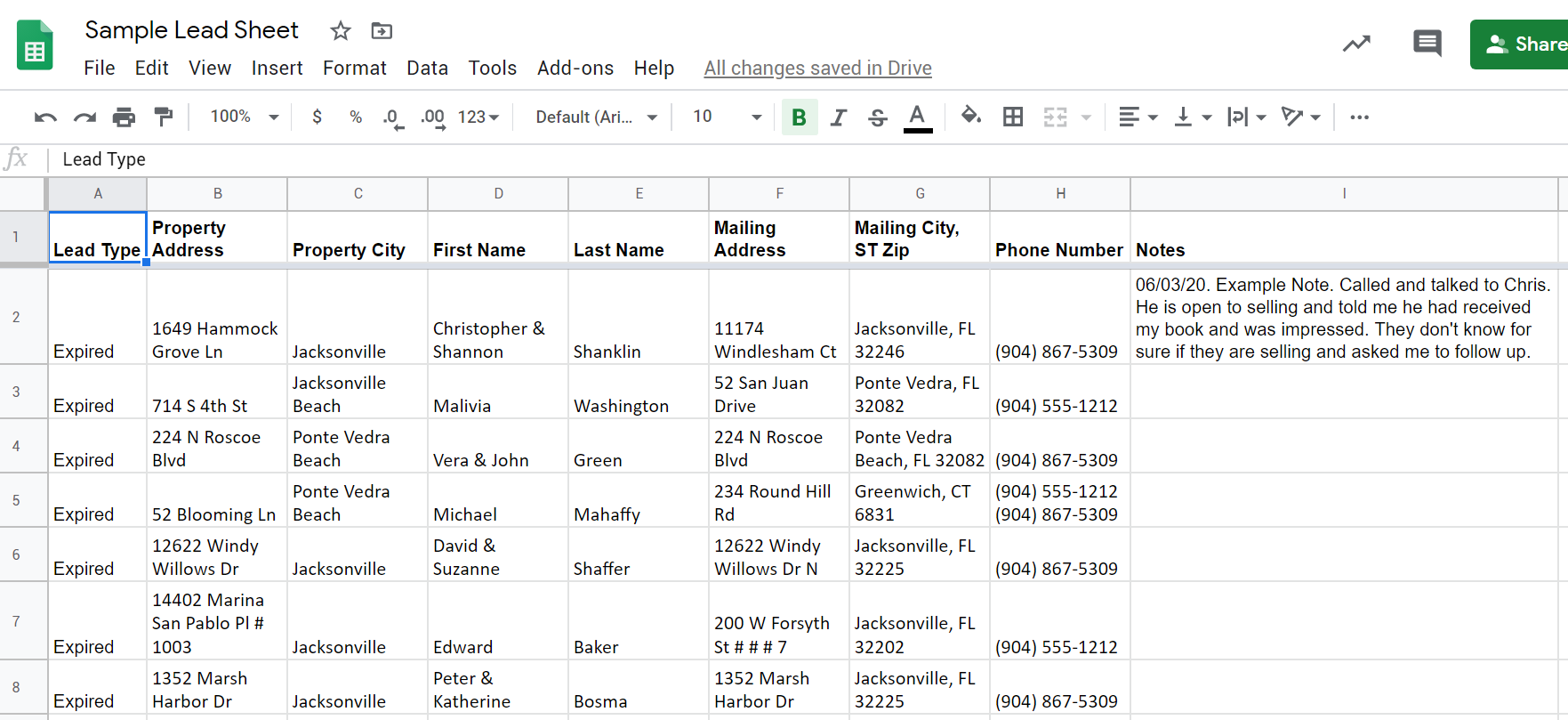

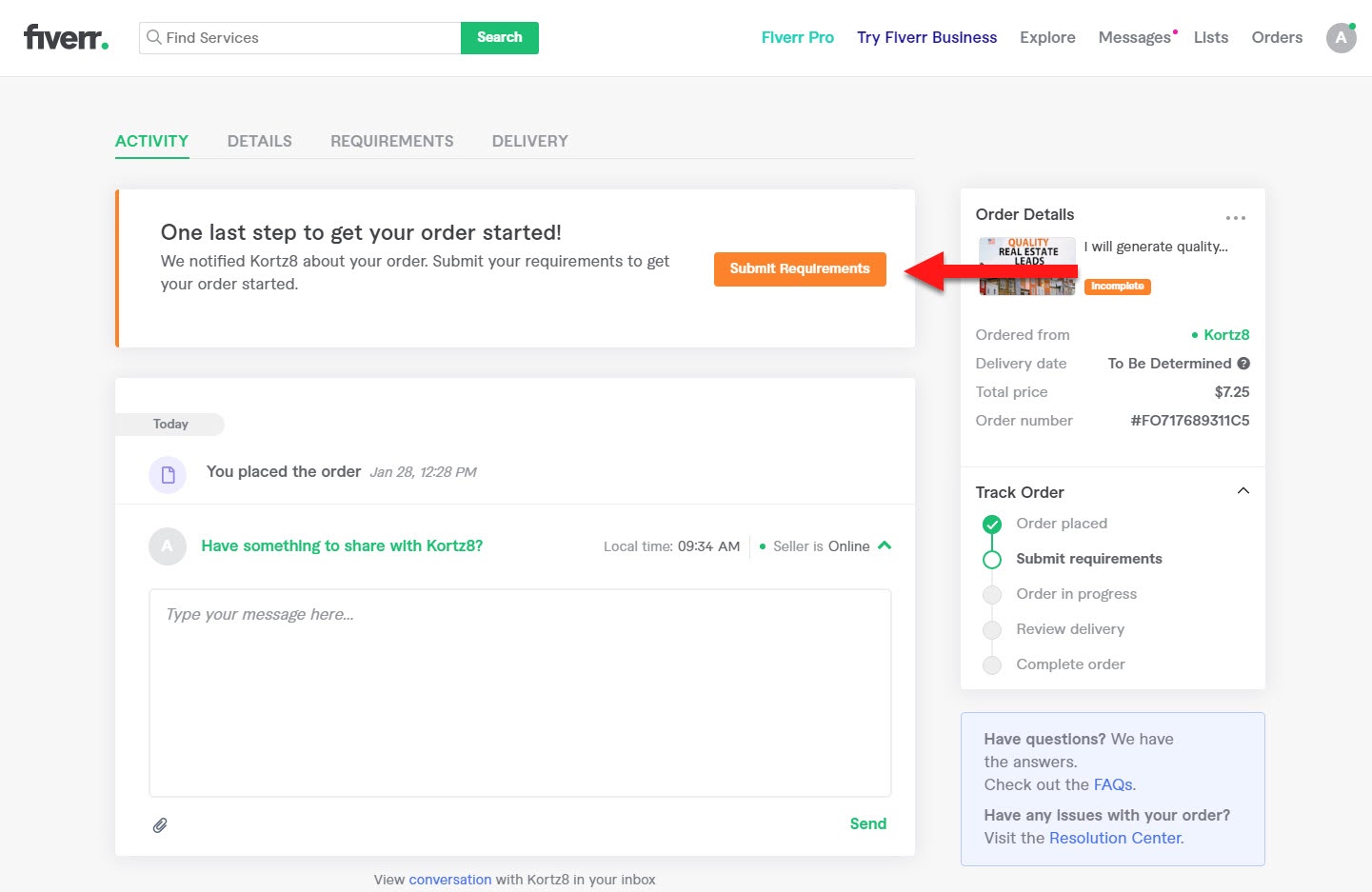

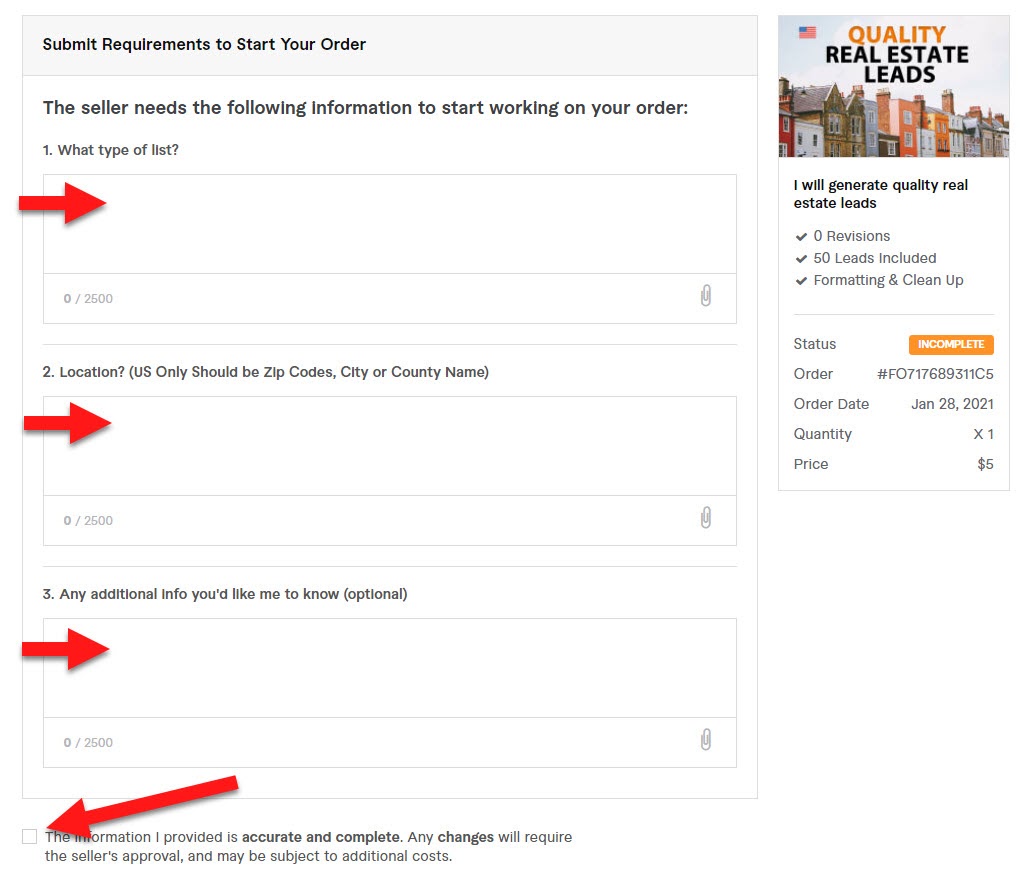

Option #1: Buy the leads from a paid lead provider.

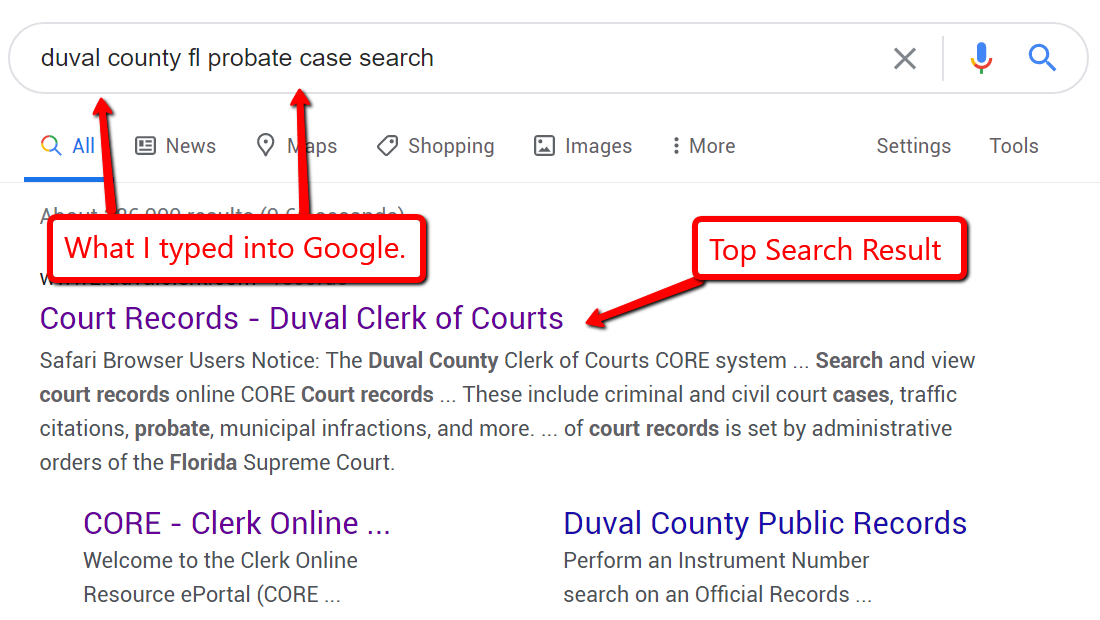

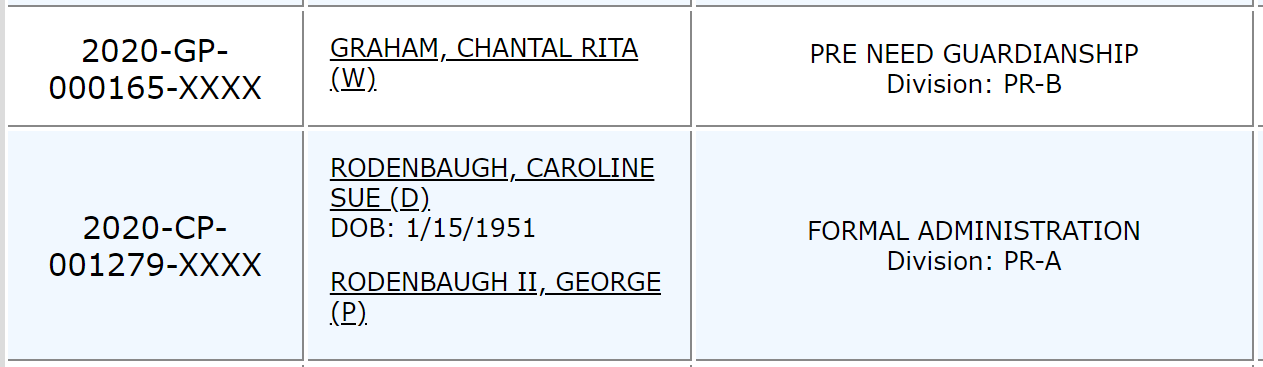

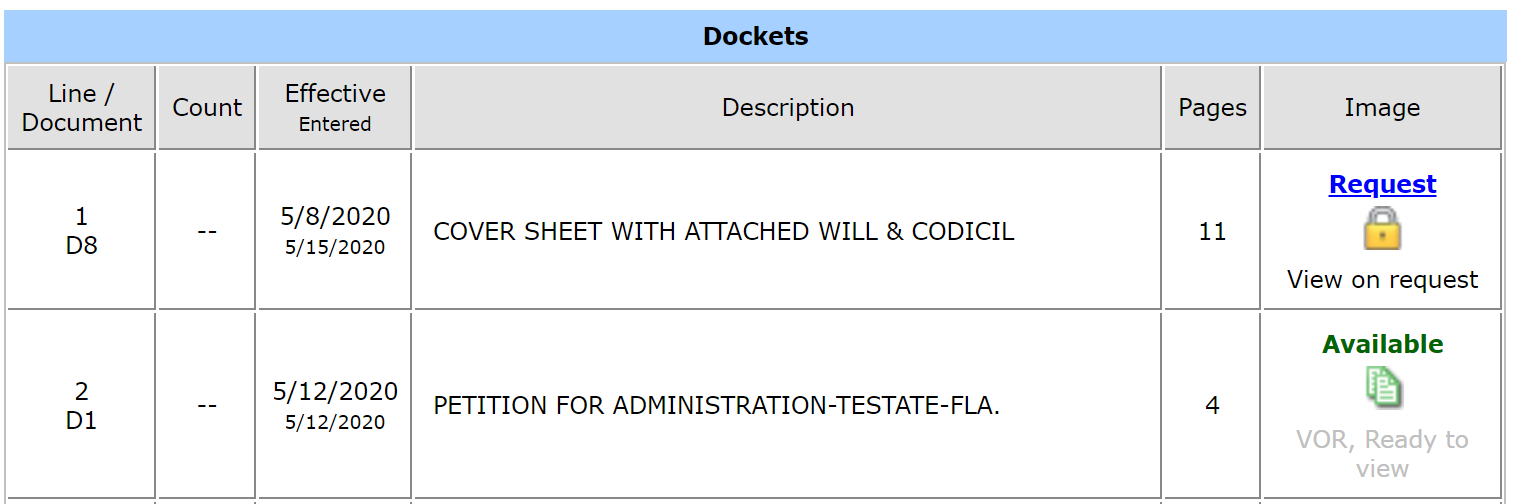

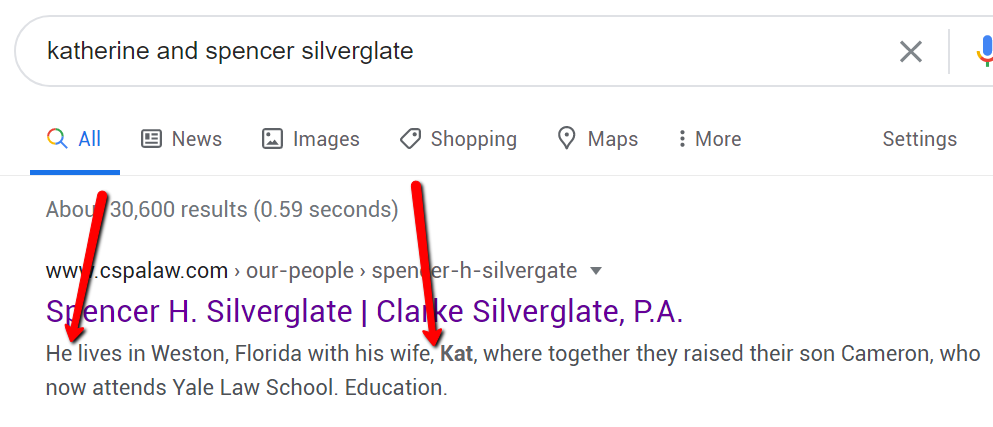

Search Google for Inherited Lead Providers in your area. For example, search “County Name ST Probate Leads.” I did that and discovered that you can get probate court case filings from the local Legal Newspaper.

We found a few companies that will provide you with probate leads. We have no experience using them, but you may want to try them out. Those companies are Probate Leads (https://probateleads.com/) and US Probate Leads (https://usprobateleads.com/.)

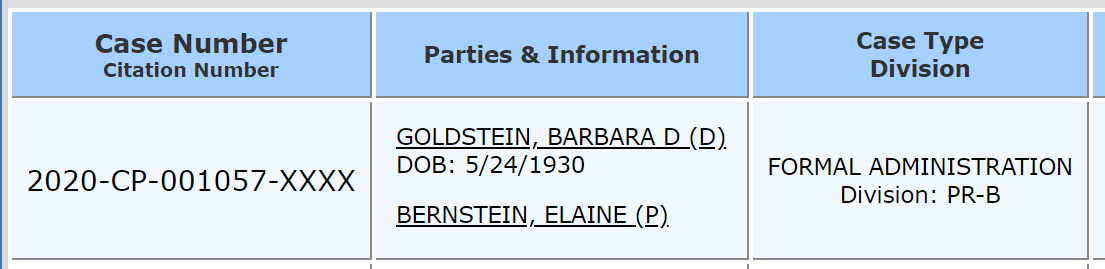

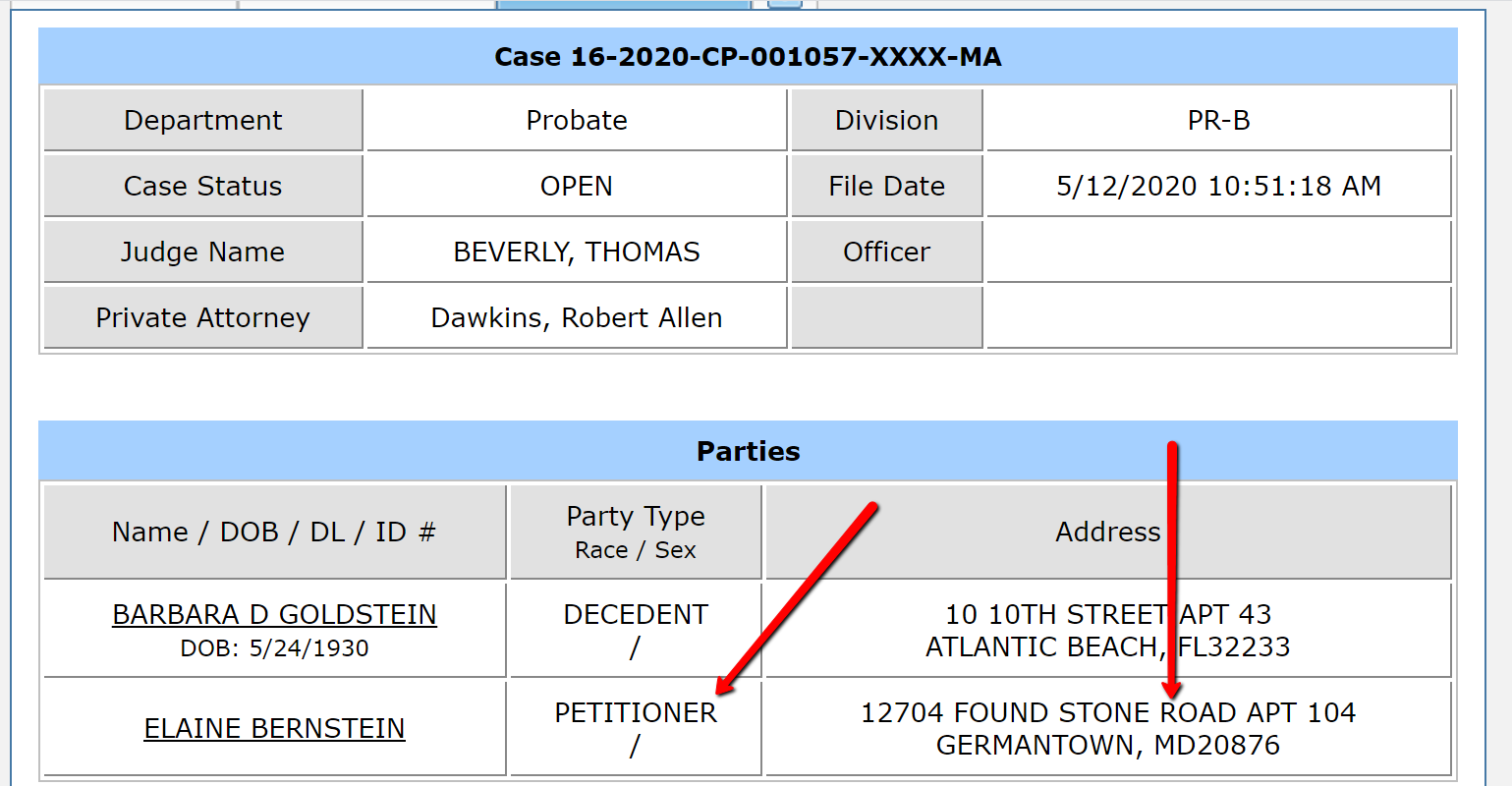

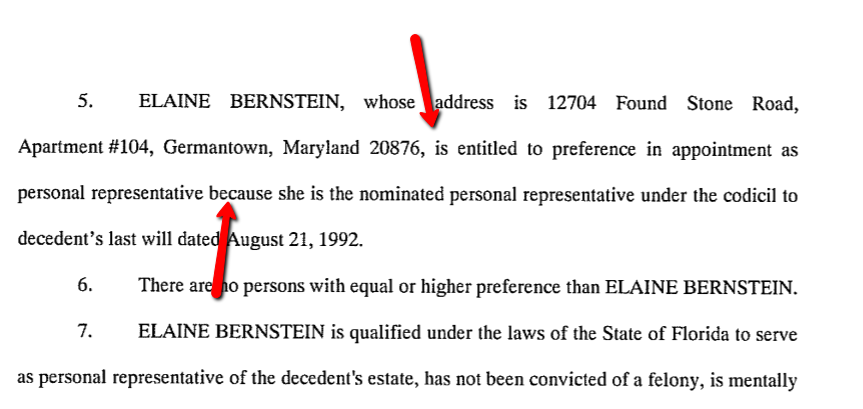

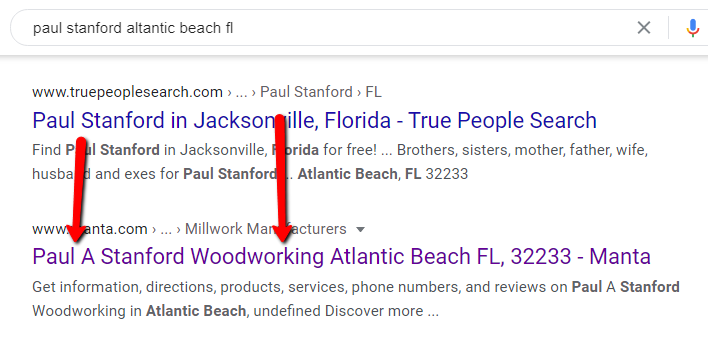

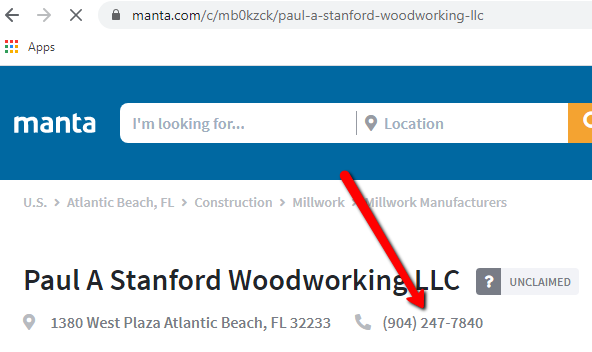

Once you find the Inherited Home, the next step is to find the decision maker so you can contact them. I show you how to do that in Step #2 above.

Option #2. Find Inherited Homes by searching for the word “Estate” in your local property records.

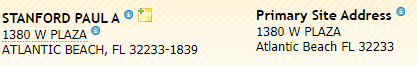

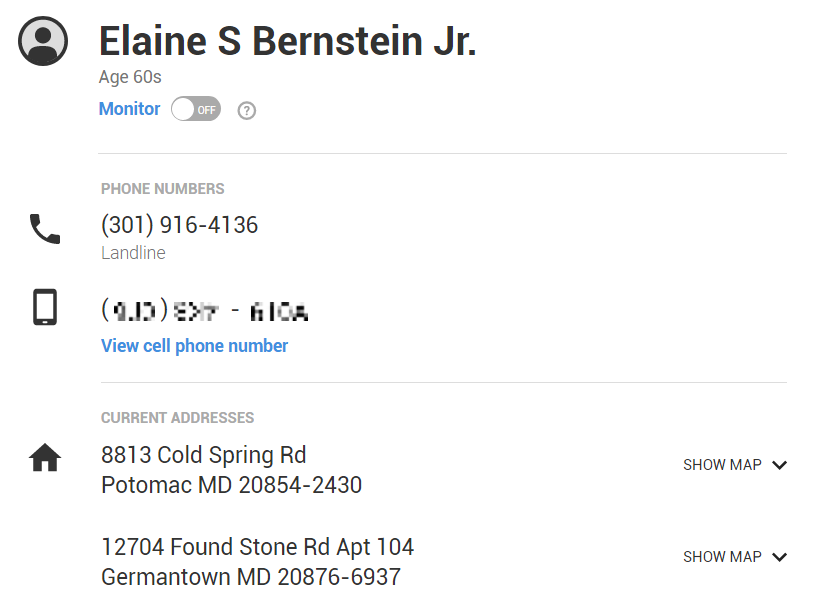

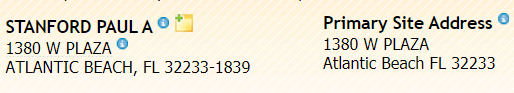

You’ll want to search the property records in your area. Most counties have that information available online on the Property Appraiser or Tax Assessor’s website. If that isn’t available, you may be able to get the information from your MLS or a company like Property Shark.

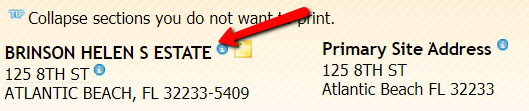

Once you get access to the database, search for the word “Estate” in the Owner Name Field. This will usually return Inherited Homes that are owned by an estate.

You’ll want to weed out properties that have “Life Estate,” “Real Estate,” “Estates,” or any other lead that doesn’t look correct.

Below is an example using the Duval County, Florida Property Appraiser’s Website. I found 173 properties like this in Atlantic Beach, Florida — which is a high-end area near our office. I highlighted several properties that look promising.

You’ll want to weed out properties that have “Life Estate,” “Real Estate,” “Estates,” or any other lead that doesn’t look correct.

Below is an example using the Duval County, Florida Property Appraiser’s Website. I found 173 properties like this in Atlantic Beach, Florida — which is a high-end area near our office. I highlighted several properties that look promising.

There were a total of 30 promising leads in Atlantic Beach, which has a population of about 14,000 people.

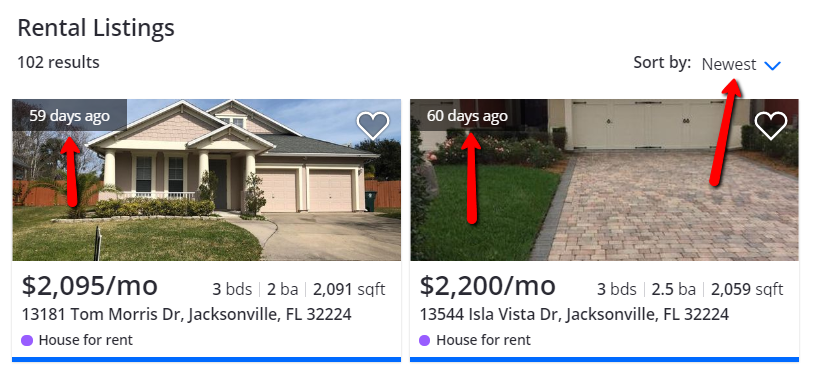

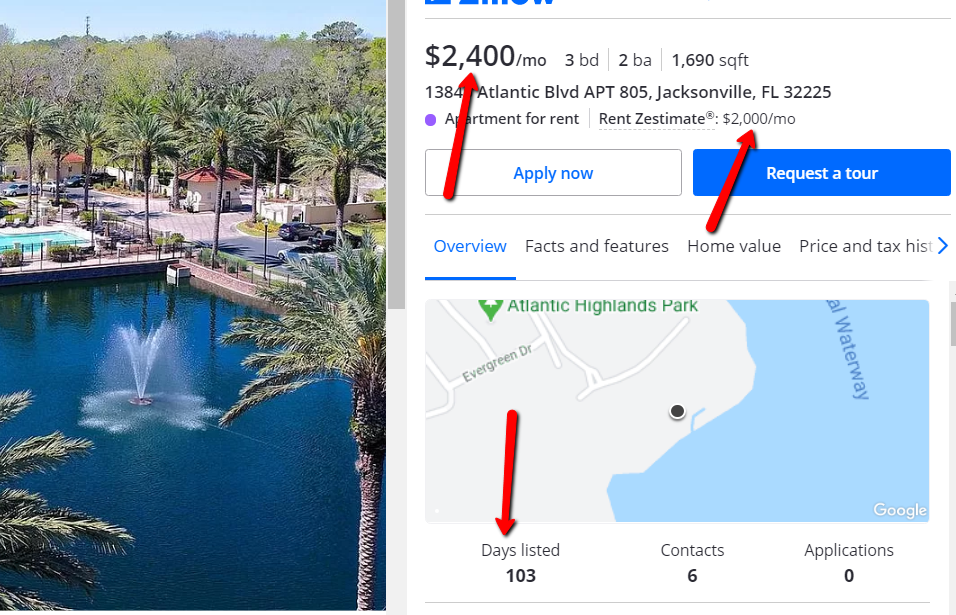

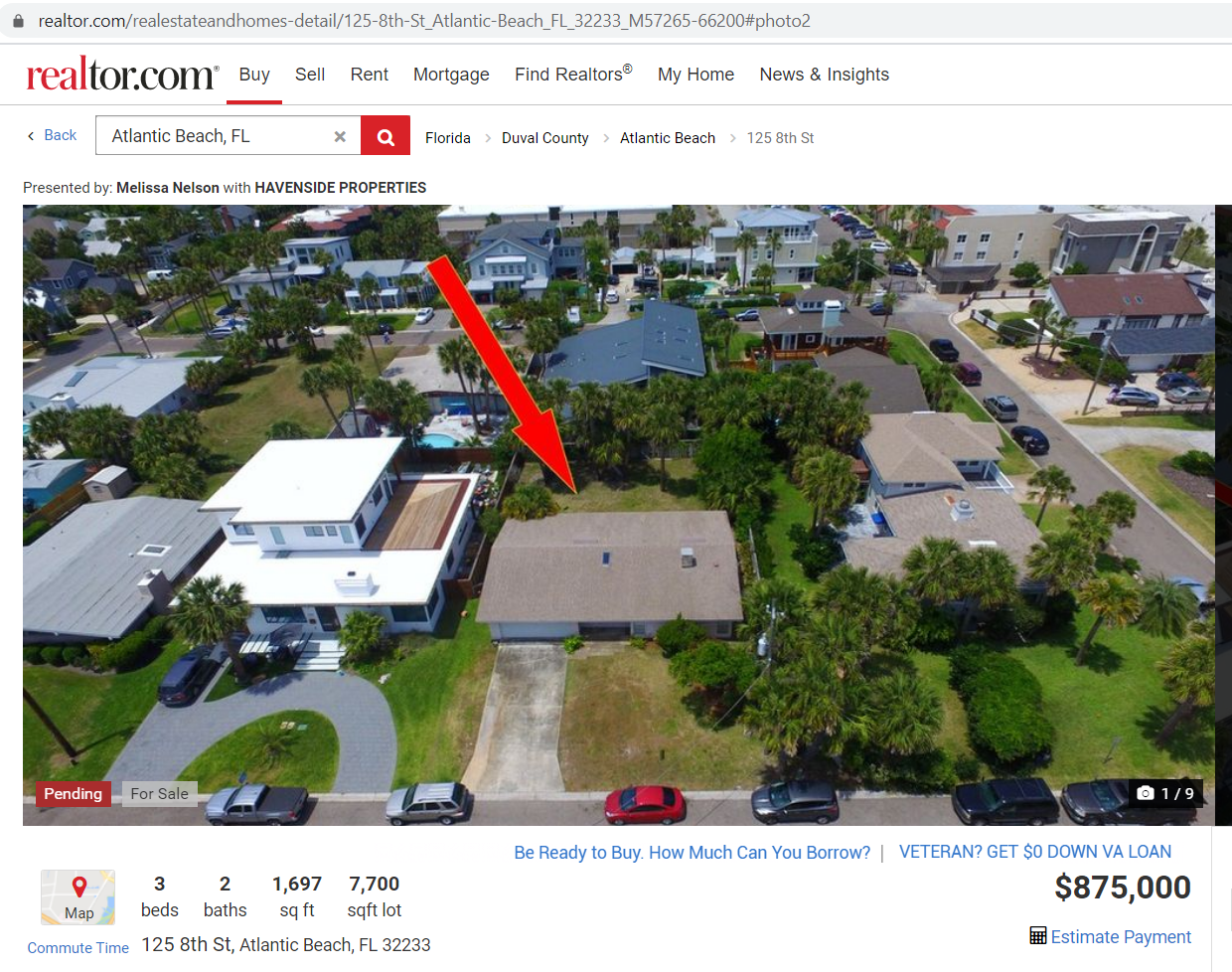

One of these homes is already Pending. See below.

Now that you know how to do this, go and try it out using your local property records.

Once you find the Inherited Home, the next step is to find the decision maker so you can contact them. I show you how to do that in Step #2 above.

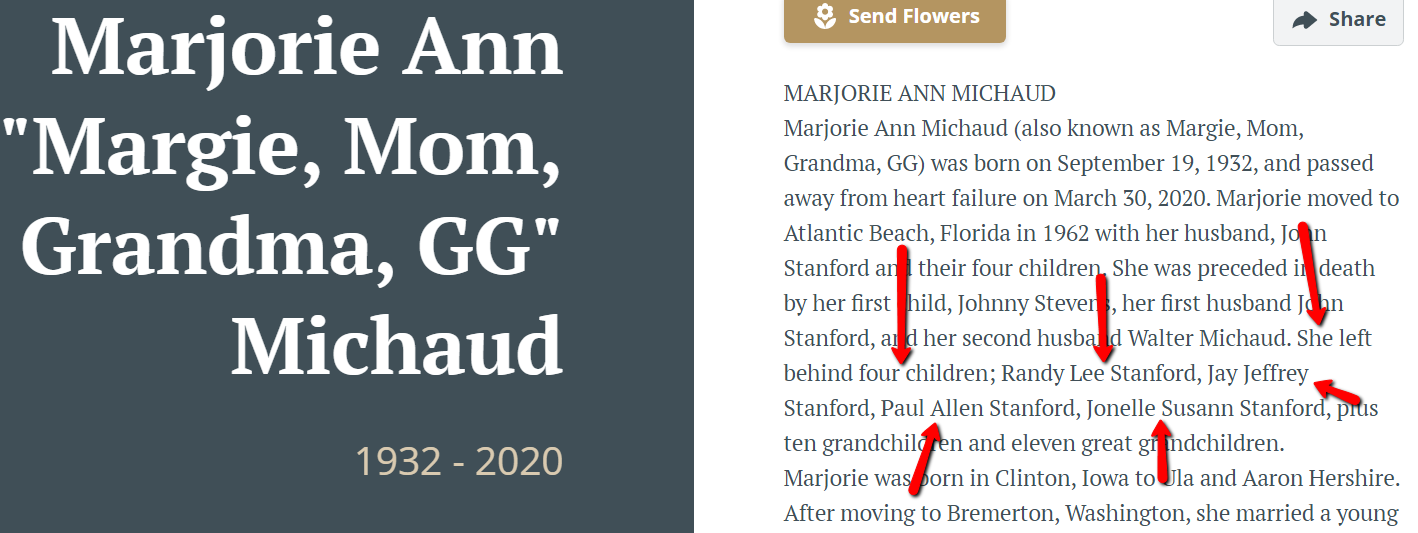

Option #3. Find Inherited Homes using Obituaries.

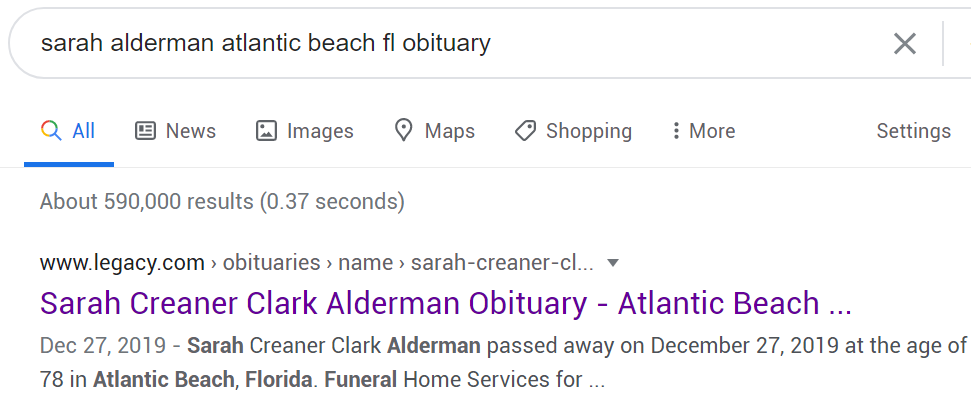

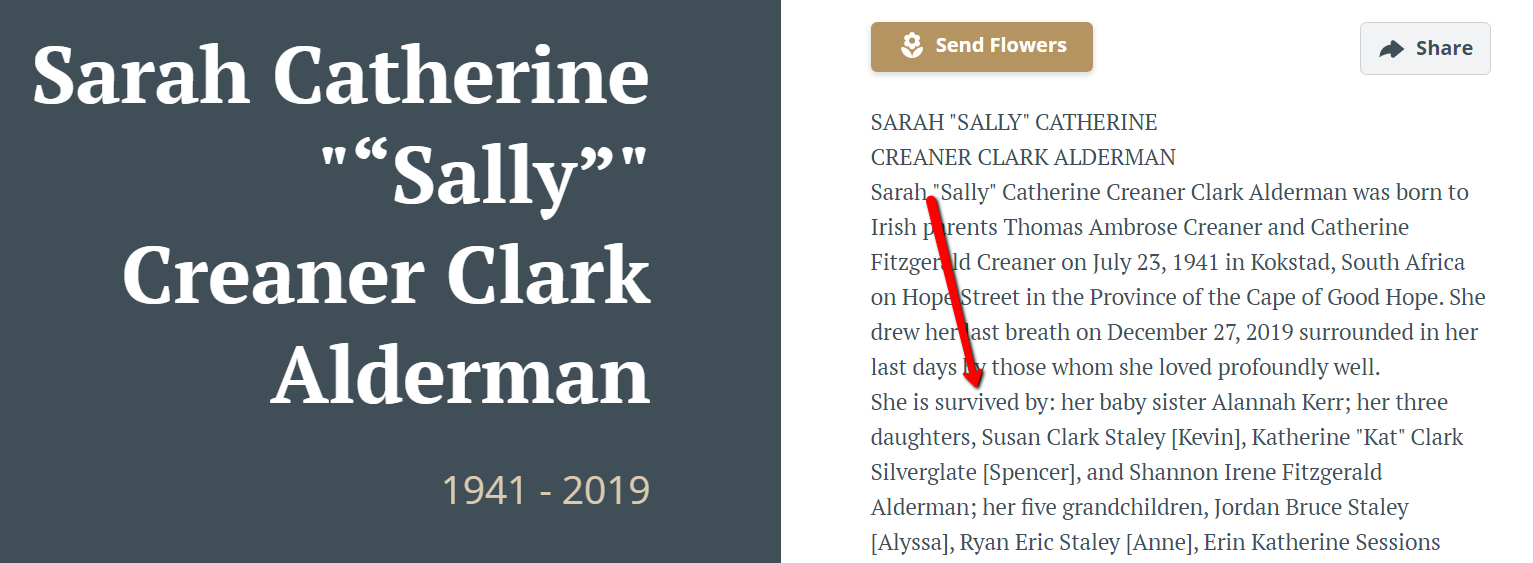

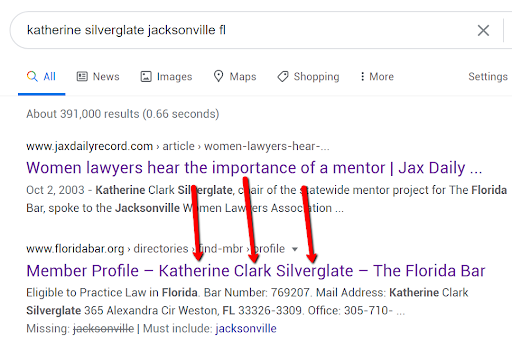

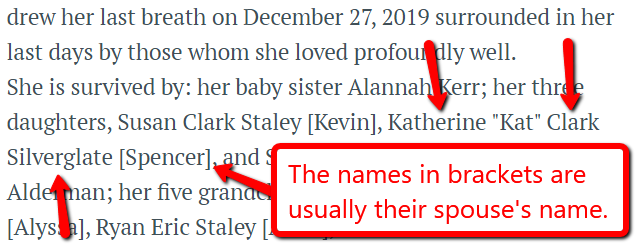

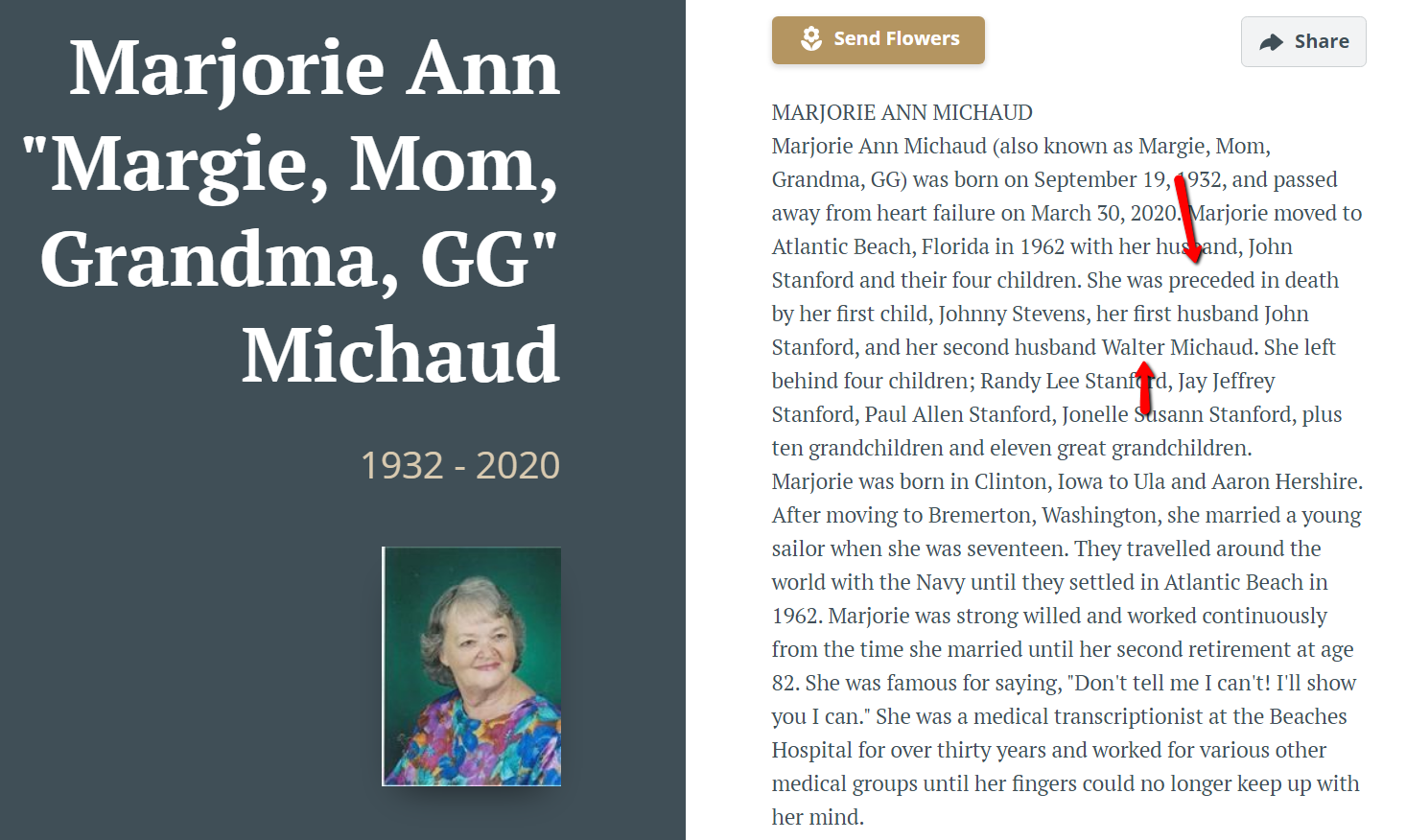

You can find Obituaries in your local newspaper, or on websites like Legacy.com, Tributes.com, or Funeral.com. Legacy.com is the biggest, so I’ll show you an example from there.

I found a list of recent obituaries in Atlantic Beach, FL, on their site.